Medicare Enrollment Closes December 7th - Are You Prepared?

Hello Eagle Wealth Community,

Medicare open enrollment ends on December 7th. If you’re on Medicare (or enrolling for the first time) now is a good time to compare plans, make sure you have the coverage you need, and potentially save money.

It’s no secret that Medicare parts and plans are downright confusing.

So confusing, in fact, that many people unknowingly choose the wrong plan that ends up costing them thousands of dollars in surprise medical expenses from a doctor visit, a treatment, or simply filling a prescription.

Healthcare costs are one of the biggest expenses retirees face (but can be very manageable with the right knowledge!) which makes choosing the right plan even more important.

So, whether you’re enrolling for the first time, or you’re already on Medicare, we highly recommend you download our that will help you choose the right plan that could save you thousands.

Inside, you’ll get the answers you need to these critical questions:

- What do you need to decide before you enroll?

- Already enrolled? Could you save money with a different plan?

- Do you need supplemental coverage or Medigap?

This simple guide takes the confusion out of Medicare to help you confidently choose the plan that’s right for you.

If you have any questions about Medicare or would like personal help comparing options based on price and coverage, give us a call. We’re more than happy to help.

Kind Regards,

Your Eagle Wealth Team

Have you ever wanted to cheer someone up who’s had a run of bad luck? Maybe you’ve been trying to think of an act of kindness, but you haven’t found the right idea.

A client recently told us about their nominee for the Invested in Community program. A family from their church recently faced numerous health challenges and needed an uplifting surprise.

“We’d been wanting to bless them in some way, and this seemed like the perfect opportunity. We chose our family hang out, El Rancho Grande. We’ve been going there for years and love the food and the service”.

We sent them a $100 gift certificate to locally owned restaurant El Ranch Grande to give away.

If you’re looking for a mood boost, treat someone just because – it’s guaranteed to put a smile on your face. We’re sad to say this is our last story of the 2020 series but stay tuned for our next round of Invested in Community beginning this winter.

The Week on Wall Street

Stocks treaded water last week amid fading prospects for a stimulus bill, fears of a second wave of COVID-19 cases, and increasing political and regulatory pressures on Big Tech companies.

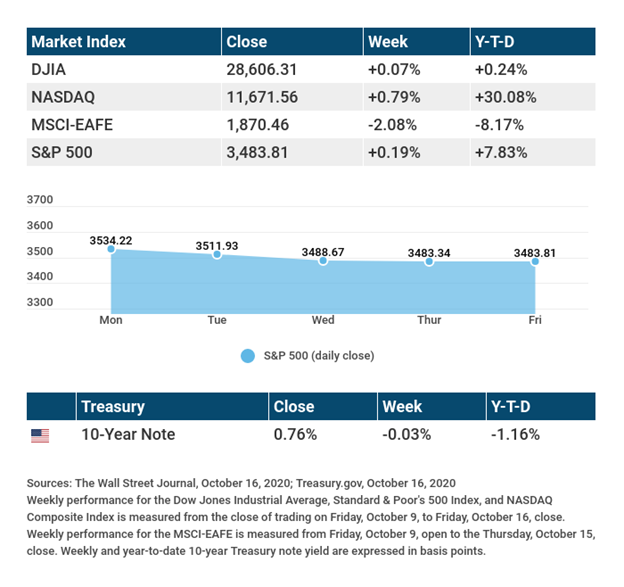

The Dow Jones Industrial Average added just 0.07% while the Standard & Poor’s 500 eked out a gain of 0.19%. The Nasdaq Composite index picked up 0.79% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, slid 2.08%.[i],[ii],[iii]

Rocky Week

The stock market began the week by posting strong gains on hopes of a fiscal stimulus bill. Also, investors were optimistic that earnings season would reflect an improving picture of corporate performance.

But stocks stumbled midweek on a mixed bag of early earnings results, and an increase in COVID-19 cases in the U.S. and Europe. Disappointing news on some key COVID-19 treatment trials also weighed on the market, as did a jump in new jobless claims and a continued stalemate on a fiscal stimulus package.

Stocks attempted to rally on Friday, emboldened by strong retail sales, but lost momentum as trading came to a close.

Earnings Season Kicks Off

Earnings season began on an upbeat note as major banks mostly beat on revenue and profit expectations. Banks attributed the strength to rising consumer deposits, a drop in the amount of money set aside for failing loans, and strong results from their investment banking and trading units.[iv]

Airlines fared less well. Investors were disappointed with the quarterly reports even though the average daily cash burn at these companies generally improved. Airline management uniformly accompanied their earnings announcements with warnings of continued near-term weakness due to COVID-19.[v]

THIS WEEK: KEY ECONOMIC DATA

Tuesday: Housing Starts.

Thursday: Jobless Claims. Existing Home Sales. Index of Leading Economic Indicators.

Source: Econoday, October 16, 2020

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THIS WEEK: COMPANIES REPORTING EARNINGS

Monday: Halliburton (HAL), PPG Industries (PPG), International Business Machines (IBM)

Tuesday: Netflix (NFLX), Lockheed Martin (LMT), Procter & Gamble (PG), Snap (SNAP), Texas Instruments (TXN)

Wednesday: Verizon (VZ), Abbott Laboratories (ABT), CSX Corp. (CSX), Chipotle Mexican Grill (CMG)

Thursday: AT&T (T), Intel Corp. (INTC), Coca Cola Co. (KO), American Airlines (AAL), Southwest Airlines (LUV)

Friday: American Express (AXP)

Source: Zacks, October 16, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.