News from EWM and the Quarterly Report

Hello Eagle Community,

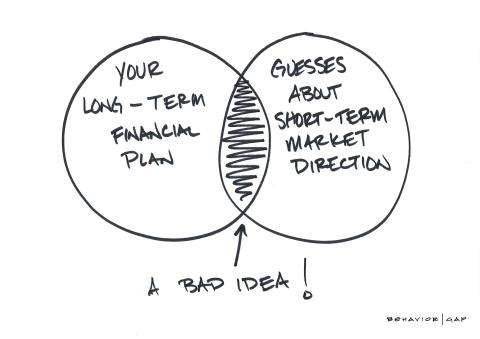

Another week of virtual work for us at EWM. We don’t know about you, but we’re missing seeing each other and all of you in the office. It’s necessary and important to do our part, but not very fun. We’re settled in to our new “normal” with video meetings, email, and of course phone chats. We’re still focused on your financial life plans, and helping you reach your goals. Your portfolios were built to weather the storms, and we will get through this together. Please know we are thinking about you and your safety. Don’t hesitate to call if we can help you out or if you just want to check in!

Yours,

Chad Staskal and the EWM team

EWM In the News

KTVZ news channel 21 turned to Eagle Wealth Management for guidance during the COVID-19 pandemic. Watch CERTIFIED FINANCIAL PLANNERTM, Suzanne Daniel, speak about the current market volatility.

Remember the Past

The stock market is nothing but repetitive, and it is part of the reason experts can predict what will happen. So, let’s take the 2008 recession. The market started to tank, and investors were panicking. However, within a few months the stocks were back to normal and the market eventually corrected itself. No matter the issue throughout history, the market has always returned to normal. We don’t know when “normal” will return this time, and it certainly won’t be overnight, but we know we’ll get through this together. As always, call us if you have questions or if you just want to check in!

The Week on Wall Street

Modest declines in stock prices this week masked the volatile inter- and intraday price swings as investors digested poor economic data and a warning from the president that the worst days of the COVID-19 pandemic may still lie ahead. The Dow Jones Industrial Average slipped 2.70%, while the Standard & Poor’s 500 dropped 2.08%. The Nasdaq Composite Index declined 1.72%. The MSCI EAFE Index, which tracks developed overseas stock markets, slid 2.76%.[i],[ii],[iii]

The Quarter in Brief

The spread of COVID-19 sent stocks tumbling in the first quarter as health and economic costs of the pandemic began to mount. Stocks remained under pressure, despite the Federal Reserve’s lowering of short-term interest rates and the government’s stimulus efforts through the Coronavirus Aid, Relief, and Economic Security Act (CARES) Act. The DJIA sank 23.2% and the S&P 500 dropped 20% on the quarter. The COVID-19-related volatility in the market has left all but a handful of sectors in a prolonged period of uncertainty. With millions of Americans staying at home in an effort to “flatten the curve” of COVID-19’s impact on people, businesses are coping with closing for the duration, altering practices, or facing staffing issues.[iv]

Oil Turbulence

The oil market dominated the commodities headlines during the first quarter. The failure of Russia to join Saudi Arabia in supporting lower oil production targets left Saudi Arabia fuming and responding with an announcement of its intention to raise oil output. Oil prices plummeted on the news, contributing to the stock market’s woes. While lower oil prices represent a boon to consumers in the form of lower gasoline prices and a relief to companies with high energy consumption (e.g., airlines, chemical), they also pose a risk to the American energy industry.

Should low oil prices persist, it may lead to lower capital expenditures, labor force reductions, and troubles in the credit markets as less-capitalized companies struggle to meet their debt obligations. As the quarter came to a close, there was some speculation that President Trump would take a larger role in working with Russia and Saudi Arabia on production targets.

What’s Next

It is difficult to see, in the middle of the COVID-19 epidemic, exactly what the full impact will be. Suffice it to say, the cost in human terms has been staggering so far and seems certain to affect at least part of the coming quarter. As people and businesses adapt to extended periods of quarantine, the only thing that seems clear is that no aspect of American life will be unchanged. CARES Act stimulus checks are on the way for millions of Americans. The Federal Reserve has lowered interest rates. Further measures are being considered at the state and federal levels. The only two things that seem truly certain are that action is being taken and that we’ll all breathe a sigh of relief once this crisis subsides.

Neil Diamond is a favorite artist for Chad and Cami from when they first started dating in 2001, and they even flew to Reno in 2002 to watch Neil perform live. If you’ve got extra time on your hands and you’re a Neil Diamond fan, check out his COVID-19 song.

Or if you’re a Sound of Music fan like Cami (but sadly, not Chad), try this one.

[i] The Wall Street Journal, April 3, 2020. The market indexes discussed are unmanaged and generally considered representative of their respective markets. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

[ii] The Wall Street Journal, April 3, 2020. The market indexes discussed are unmanaged and generally considered representative of their respective markets. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

[iii] The Wall Street Journal, April 3, 2020.

[iv] CNN.com, March 31, 2020