|

Hello, Smartphones have become a major target for cyberattacks lately because they’re always connected to the internet, store lots of personal data, and are used for important things like banking. More people are using their phone like a computer and don’t always take the same security precautions as they would with their desktop computer.

Why Cyberscammers Target Phones

- Frequent App Downloads: Many users download apps from third-party sources, often laced with malware, allowing attackers to compromise the phone’s security. The malware apps are designed to steal data, monitor activity, or send unauthorized messages from compromised phones.

- Lax Security Measures: Most users rely on simple passwords or screen locks, ignoring more robust security features, making phones an easy target. Here are two government agency best practice tips for smartphone security:

- Unsecured Wi-Fi Networks: Public Wi-Fi can leave devices vulnerable to attackers who exploit unsecured connections to access data.

While not all cyberattacks involve spam calls, they’re a big part of the problem. In the first half of 2024, over 19 billion calls were flagged as spam globally, with a third being unwanted—22% nuisance and 7% fraudulent. 1,2

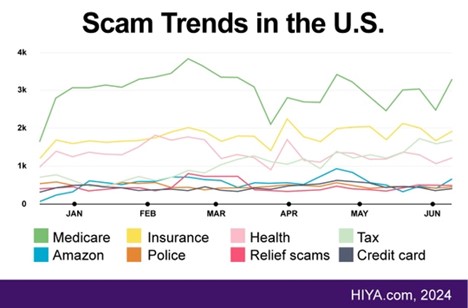

The chart below shows several of the most common scams you might already be the target of—ranging from Medicare scams to insurance fraud.

How to Recognize and Stop Common Phone Scams

In the first half of 2024, the most common phone scams in the U.S. were related to health insurance, particularly targeting seniors on Medicare. Despite ranking first, Medicare scams declined compared to previous levels, which peaked in November 2023 during the Medicare open enrollment period.

Key Takeaway: If you get a pushy call offering free medical supplies or asking for personal info, it’s better to hang up and talk to a professional. 1,2

Next on the list were broader insurance scams covering health, auto, life, and home insurance. Health product scams came in third, while tax scams moved up to fourth place. With the tax deadline near, scammers might use fake penalty warnings.

Key Takeaway: Don’t trust a caller just because they claim to be from the IRS or an insurance company. If you’re unsure, ask for their phone number to call them back—scammers usually won't provide that. 1 ,2

Other scams rounding out the top ten included relief scams (such as those offering debt, mortgage, and student loan relief), credit card fraud, and threats of arrest from fake police calls.

There’s no foolproof way to catch every scam, but taking your time and carefully evaluating a situation when you’re unexpectedly contacted by unknown sources can help you detect fraud.

Here are some additional tips to help you stay ahead:

- Don't answer unknown numbers. Let it go to voicemail.

- Don't give out personal information, especially passwords or Social Security numbers.

- Do hang up on any caller claiming to represent a business or entity and verify information by calling the company or agency directly.

- Do register with the National Do Not Call Registry (DNC) list.

- Do use call blocking through your phone provider.

- Do report scam calls to the Federal Trade Commission (FTC).

Phone scams are preventable. With a bit of patience and careful attention, you may be able to manage your risk and stay safer in an increasingly digital world.

Sincerely,

Your Eagle Wealth Team

P.S. National “Slam the Scam” Day is Thursday, March 6, 2025. This is a day designated by Social Security’s Office of the Inspector General to raise awareness of government imposter scams, which continue to spread across the United States. Check out the Social Security Administration’s website for more information. |

|

|

|

How much does your pocket change cost? More than a pretty penny, it seems.

According to the U.S. Mint, each one-cent coin costs 3.69 cents to make. This means that for the 19th year in a row, the production and distribution costs have exceeded the actual monetary value of the penny, a trend that has persisted since 2006.

Our five-cent piece isn't doing much better, considering the $27.8 million it took to make the 202 million nickels in circulation—nearly three times their collective worth.

There are many reasons for the increased cost, from anti-counterfeiting measures to the increasing price of materials like copper, zinc, and nickel.

Luckily, the other coins in the U.S. Mint's change purse (dimes, quarters, and 50-cent pieces) remain cost-effective to produce, largely because their value exceeds their manufacturing costs.

Does this mean the penny could be going away?

Here’s our two cents.

The U.S. Mint has been producing fewer pennies and nickels in recent years to minimize losses. In the 2024 fiscal year, approximately 3.2 billion pennies were minted, down from 5.3 billion just three years earlier.

Other countries, such as New Zealand and Australia, discontinued their pennies in the early 1990s. Canada discontinued theirs in 2012.3

Will the U.S. follow suit?

Only time will tell. |

|

|

1. HIYA.com, 2024

2. Federal Trade Commission, 2024

3. NBC News, February 11, 2025 [https://www.nbcnews.com/data-graphics/trump-aims-eliminate-penny-see-much-costs-produce-penny-nickel-rcna191739] Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general. U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors. International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility. Please consult your financial professional for additional information. This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security. Copyright 2025 FMG Suite. |

|

|

|

|

|