What Exactly is a Roth Conversion?

In many ways, retirement planning is about envisioning the life you want. Where you want to live, what you want to do, how much you want to spoil your grandkids…

On the advisor’s side, retirement planning is a bit more technical. Investing, risk tolerance, tax planning, Social Security optimization – we love this stuff, but we know most of our clients prefer to leave the details to us and focus on the goals.

With that being said, there are a few retirement planning tricks that I believe are important for our clients to understand – one of which is the Roth conversion.

What exactly is a Roth conversion?

In short, it’s taking money out of a tax-deferred account like a Traditional IRA or 401(k) and putting it in a Roth IRA, which is a tax-free account. In the process of doing this, you pay taxes on the amount you transfer.

Why do it if you’re going to have to pay taxes? Simple. The money in tax-deferred accounts has not been taxed yet – you pay taxes when it is withdrawn.

The key to a Roth conversion is that the tax rate you pay on money in tax-deferred accounts is based on your income level when you withdraw it.

There are a few reasons people perform Roth conversions, but one of the main ones comes down to one simple question:

Will your taxes be lower now or later?

If the answer is later, then the task is fairly simple: Pinpoint when your taxes will be at their lowest and perform a Roth conversion then.

If the answer is now, the task is basically the same, with one small tweak: Consider a conversion now (or withdraw the money from these accounts).

Of course, no one can guarantee what your income level will be for the rest of your life. But if you have a financial plan, you have a much higher likelihood of knowing when your income will be lowest.

Like I said, there are other reasons to perform a Roth conversion. The other week, we talked about building a legacy, part of which involves bequeathing assets for your loved ones. If you leave money in tax-deferred accounts, then you don’t really know how much you’re leaving in the end. The IRS will get their cut at some point – they don’t care if it’s from you or your children or grandchildren (and their tax rates could be much higher than yours).

For what it’s worth, we are fans of the Roth conversion as a planning tool in general. To be clear: I’m not saying it’s right for everyone or that you should do one right now! But it can be an incredibly effective lever to pull for tax minimization purposes.

If you are a current client, then we probably have already looked at the suitability and timing of Roth conversions for you. But it never hurts to discuss if it would help as you're thinking about this topic, so give us a call. If you're not a client and want to learn more about how a Roth conversion could be incorporated into your plan, feel free to call us and we'll do our best to help.

Have a great week,

Chad Staskal CFP®, ChFC, CLU

Founding Partner and CEO

*As always, consult your tax professional for guidance tailored to your specific financial situation and that takes the latest tax laws into account.

Gingery Asian Noodle Salad with Turkey and Cucumbers

Serves 4

Ingredients:

1 package vermicelli rice noodles

¼ cup rice vinegar

2 teaspoons granulated sugar

1 tablespoon freshly grated ginger

1 teaspoon freshly grated ginger

Kosher salt

1 red pepper

1 red Chile pepper

3 ounces snow peas

½ seedless cucumber

1 tablespoon canola oil

1 pound lean ground turkey

¼ cup hoisin sauce

2 scallions

Directions:

1. Follow the package directions in cooking the noodles.

2. Drain and rinse the noodles under cold water.

3. At the same time, stir together in a large bowl the vinegar, sugar, 1 teaspoon ginger, and ¼ teaspoon of salt.

4. Add peppers, snow peas, and cucumber. Toss to combine.

5. Heat the oil in a large nonstick skillet over medium heat.

6. Add the turkey and cook. Use a spoon to break it apart until it’s no longer pink, 5-6 minutes.

7. Stir in the hoisin sauce, the remaining ginger, and 2 tablespoons of water.

8. Cook for 1 minute before gently mixing in the scallions.

9. Serve the noodles with the cucumber salad and turkey.

*Recipe adapted from Good Housekeeping

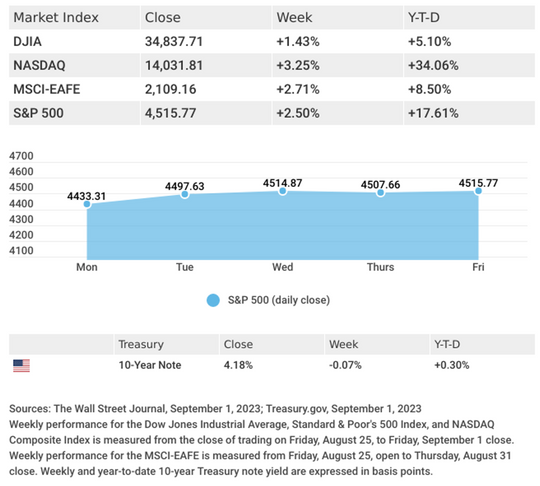

The Week on Wall Street

Falling bond yields–spurred by weak economic data–helped lift stocks to weekly gains.

The Dow Jones Industrial Average advanced 1.43%, while the Standard & Poor’s 500 gained 2.50%. The Nasdaq Composite index increased 3.25% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, picked up 2.71%.1,2,3

Stocks Rise On Slowing Economy

Investor sentiment turned positive last week as signs of economic softness were interpreted as reason for the Fed to hold off on further rate hikes. A downward revision of Q2 economic growth and fresh signs of a cooling labor market reversed the recent rise in bond yield. They helped trigger a stock bounceback following Fed Chair Powell’s speech at Jackson Hole the previous Friday.

It wasn’t all about bad news being viewed as good news, though. A series of solid earnings reports, an announcement by one mega-cap tech name introducing pricing for its AI tools, and fresh inflation data–in-line with market expectations–further boosted enthusiasm for stocks.

Signs Of Labor Cooling

Despite historic monetary tightening, the labor market has exhibited remarkable resilience, but last week’s employment data showed a cooling trend.

Job openings declined to their lowest level since March 2021, though they remained above pre-pandemic levels. Meanwhile, a survey of private sector hiring showed a slowdown in hiring, with employers adding 177,000 jobs in August–below the 371,000 added in July and short of economists’ forecast of 200,000.4,5

Finally, the government’s monthly employment report showed the number of nonfarm payroll gains continued to decelerate in August, while June and July estimates were revised lower by 110,000.6

Any companies mentioned are for informational purposes only, and this should not be considered a solicitation for the purchase or sale of their securities. Any investment should be consistent with your objectives, time frame, and risk tolerance

Advisory Services offered through My Legacy Advisors, LLC dba Eagle Wealth Management, a registered investment advisor. Confidential Information: This message and any attachments contain information from Eagle Wealth Management, which may be confidential and/or privileged and is intended for use only by the addressee(s) named on this transmission. If you are not the intended recipient, or the employee or agent responsible for delivering the message to the intended recipient, you are notified that any review, copying, distribution or use of this transmission is strictly prohibited. If you have received this transmission in error, please (i) notify the sender immediately by e-mail or by telephone and (ii) destroy all copies of this message.

1. The Wall Street Journal, August 25, 2023

2. The Wall Street Journal, August 25, 2023

3. The Wall Street Journal, August 25, 2023

4. The Wall Street Journal, August 25, 2023

5. CNBC, August 30, 2023.

6. The Wall Street Journal, September 1, 2023.

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security. Copyright 2023 FMG Suite.