Why investors can be thankful after a volatile year

While it may not feel like it, investors do have much to be thankful for this holiday season.

Over the past year, investors have navigated both short-term challenges due to interest rate swings, the banking crisis, and political battles in Washington, as well as long-term uncertainty resulting from inflation, the Fed, geopolitical conflicts, and more.

And yet, through all of this, major market indices have held onto strong gains, reversing much of last year's declines.

So how do we maintain perspective as we reflect on the past year?

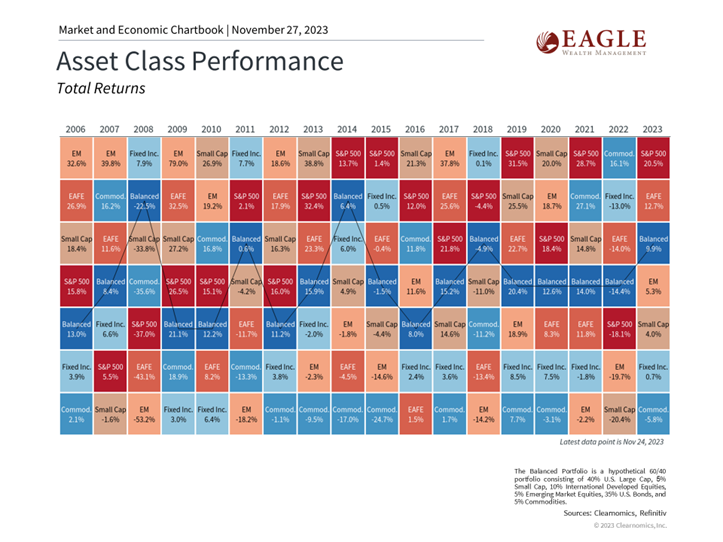

Many major asset classes have made strong gains this year:

Financial markets and the economy have defied expectations in 2023. In many ways, the current environment represents the best-case scenario for which investors and economists could have hoped just a year ago.

With only five weeks left in the year, the S&P 500 has returned 19.3% with dividends, the Nasdaq 36.0%, and the Dow 7.5%. International stocks have also performed well with developed markets gaining 11.5% year-to-date and emerging markets 4.8%.

Interest rates climbed throughout the year but have retreated in recent weeks. The 10-year U.S. Treasury yield, for instance, has declined from just above 5% to just under 4.5%. While a diversified bond portfolio has only returned about 1% this year, this is far better than last year's historic bear market decline.

An important reason for these gains is the health of the economy. One year ago, economists expected a recession by the second half of the year due to Fed rate hikes and early signs of stalling growth. But this didn’t happen. Instead . . .

- Job market - one of the strongest in history with unemployment near 3.9%

- GDP growth - 3rd quarter growth at a 4.9% annualized rate, one of fastest in recent decades.

- Consumer spending – strong throughout the year and helped drive the demand side of the economy as the supply side recovers.

- Corporate profits – some signs show they may be ready to turn around after three quarters of falling earnings.

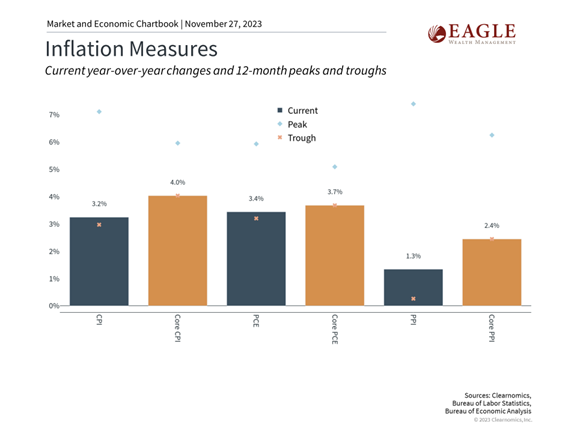

- Inflation – improved significantly, with the Consumer Price Index (CPI) in the 3% range on a year over year basis, down from a high of 9/1%.

Check out this chart on how inflation has improved:

Unfortunately, slowing inflation rates do not mean that prices will decline - only that they will rise at a slower pace. While this provides some relief, many households, especially those in or near retirement, may continue to find higher prices challenging.

From an investment standpoint, however, both stocks and bonds have already benefited from greater price stability. The fact that the Fed may be near the end of its rate hike cycle only adds to the tailwinds that have propelled markets this year.

What to do? Staying invested is still the best way to achieve financial goals.

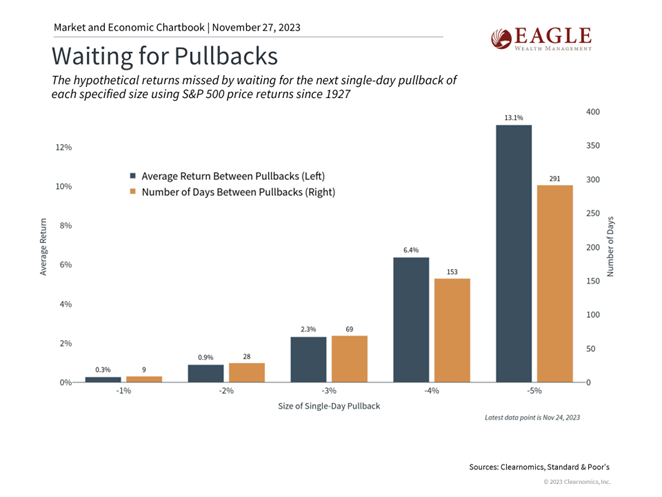

One lesson that this past year underscores is the importance of sticking to a financial plan. While it's tempting to try and time the market, history shows that it's often better to simply be invested.

This is because markets tend to rise over long periods of time, making both higher highs and higher lows. The chart below shows that investors often wait long periods before the next pullback and, in doing so, forego periods of healthy returns.

The bottom line? Investors do have much to be thankful for this year. This can be difficult to recognize since it often feels as if markets move from one crisis to another. With the benefit of perspective, it's easy to see that the economy and financial markets have come a long way, hopefully setting the stage for investors to achieve their long-term financial goals.

Medicare Open Enrollment Ends December 7th

The Medicare open enrollment deadline is swiftly approaching on December 7th, 2023. This is your last chance to review your current plan and make any changes that better suit your needs for the upcoming year. St. Charles WILL still accept PacificSource, Providence, Moda, And Regence Blue Cross Blue Shield for 2024. Read more here.

|

|

The Week on Wall StreetInvestor enthusiasm for stocks remained strong last week, buoyed by declining bond yields in a holiday-abbreviated trading week. The Dow Jones Industrial Average picked up 1.27%, while the Standard & Poor’s 500 gained 1.00%. The Nasdaq Composite index rose 0.89% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, was flat (+0.03%).1,2,3

The stock market continued to look toward the bond market for direction, responding positively to bond yields that fell steadily for much of the week. A successful 20-year Treasury notes auction on Monday triggered a decline in bond yields. The release of the minutes from the Fed’s last meeting buoyed investor optimism that the potential for further rate hikes was diminishing. Investor sentiment was also lifted by the earnings results from a leading mega-cap, AI-enable chipmaker that topped analysts’ expectations, bolstering the narrative of AI’s potential to help corporate profits. Despite a higher turn in bond yields on the final half-day of trading, stocks retained the week’s gains.

Fed MinutesMinutes from the October 31–November 1 meeting of the Federal Open Market Committee were released last week, providing insight into its decision not to raise rates and its thinking on the future direction of interest rates. The minutes reflected concerns by committee members that inflation remained stubborn and may move higher. The minutes also reaffirmed the messaging of many Fed officials, including Fed Chair Powell, that monetary policy must remain restrictive until they are convinced inflation will be on track for the Fed’s two percent target. They further said that future rate decisions will be based on fresh economic data, offering no indication that a rate cut was forthcoming, as many analysts are increasingly anticipating for 2024.

|