|

Hello, We won’t sugarcoat it—this has been a tough time for the markets.

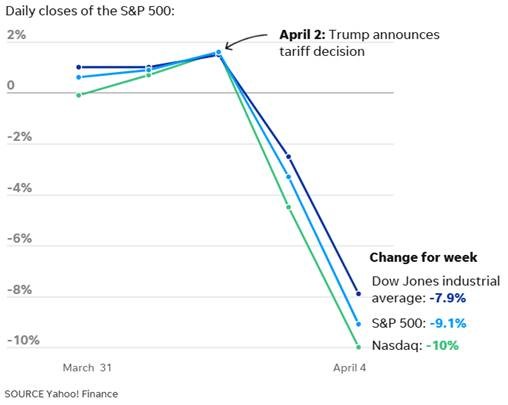

After President Trump’s sweeping rollout of new tariffs, the close of last week was the worst selloff since the early days of the COVID-19 pandemic.1 The Dow dropped 9.2%, the S&P 500 fell 10.5% and the Nasdaq tumbled to 11.4%.2 Concerns over a full-scale trade war sent global markets reeling and investor confidence took a sharp hit.

From major retailers to energy companies, few sectors were spared. At the same time, rising tariffs on auto imports and goods from countries like China, Vietnam, and the European Union are fueling fears of inflation, reduced consumer spending, and even the possibility of a recession.3

It’s no surprise if you’re feeling uneasy. You're definitely not alone.

Here’s what we want you to remember: Times like these are why we build diversified portfolios and personalized plans. You're not invested directly in the S&P 500 or the Nasdaq. Instead, your portfolio is designed to span a range of asset classes, sectors, and geographies - and we intentionally include strategies and instruments beyond equities that are intended to help cushion against volatility.

While market indexes may grab headlines when they swing, your strategy is built with long-term goals in mind, not short-term reactions.

That said, this downturn is real—and it’s unsettling. So here’s what we can do:

- Focus on what we can control, like how we react, how we stay diversified, and how we manage risk.

- Avoid the urge to panic sell, which historically has been one of the costliest investor mistakes.

- Stick to your plan, which was designed with the realities of both good and bad times in mind.

- Remember that these tariff talks are still relatively new, and we don't know how things will play out yet.

It’s also worth noting that even on tough weeks, there are bright spots. Not every sector is falling, and some defensive areas like consumer staples have held up well. This reinforces why diversification matters—because we don’t try to predict the future, we prepare for it.

Looking for more in-depth information? Check out our commentary on the Importance of Offense and Defense in Challenging Markets to learn about the significance of balanced portfolios and the opportunities during volatility.

5-minute read And as always, if you’re feeling unsettled or want to talk it through, we’re here. Just hit reply and we’ll schedule a time to chat. Your peace of mind is as important as your portfolio.

Warm regards,

Your Eagle Wealth Team

P.S. This commentary reflects general trends, not the specific results of your portfolio. Every investment strategy is personalized to your goals, risk tolerance, and time horizon. If your returns don’t match the market, that’s by design and often to your long-term advantage.

P.P.S. Need a reason to look up this week? April is delivering a celestial show, with shooting stars and a rare planetary gathering lighting up the night sky. It’s a great reminder that even in turbulent times, there’s beauty to be found above us. |

|

|

| |

EWM Teaching at COCCDo you have a friend or relative who could use some financial planning help? Then we’ve got good news. We’ve been volunteering at COCC since 2010, partnering with them on financial planning classes. We’re big believers in the power of education and this is one of the ways we’re able to give back to our community.

Since April is Financial Literacy Month, it’s the perfect time for your family and friends to check out our in-person classes at Central Oregon Community College. Forward this email to have them check out our website for more details.

Personal Retirement Analysis Workshop: **These courses are not intended for current clients. The planning we’ve done with you through personal meetings far exceeds what’s possible in a classroom of students. Please remember though, if you’ve had any changes in your life that may affect your current plan, please call us so we can discuss and make any necessary updates. |

|

|

|

| |

Jake's Best of Bend Breweries WinnerThank you to everyone who voted and played along throughout March! We hope you enjoyed it and maybe even went to a few of the breweries to see what they’re all about. Without further ado, the winner of Jake’s Best of Bend Breweries for 2025 is Sunriver Brewing!

|

|

|

|

Tax Deadline ApproachingWe’re in the final stretch of tax preparations as the filing deadline approaches on April 15th. Be sure to make any estimated tax payments by then if you owe.

|

|

|

The Week on Wall StreetStocks rallied the first half of the week as markets tried to anticipate the potential impact of tariffs previously announced by the White House.4

Soon after the closing bell on Wednesday, President Trump’s new tariffs surprised markets. Global markets reacted to the news overnight.5

Markets opened lower on Thursday, and the selling continued through Friday. Treasuries rallied in a flight to quality as investors moved to the sidelines. The yield on the 10-year Treasury note closed Friday at 4.0 percent. Bond yields generally fall when bond prices rise. 6, 7 Powell's SpeechFederal Reserve Chair Jerome Powell gave a previously scheduled and much-anticipated speech on Friday. He explained: The labor market is in good shape and not a significant source of inflation. Longer-term inflation expectations are “well anchored and consistent with our 2 percent inflation goal” – despite higher expectations for inflation over the short term. Regarding consumer sentiment, while consumers “may not feel great about the economy now, they still keep spending.” He added that the same happened during the pandemic. The Fed’s policy stance is “well positioned to wait for greater clarity… (on the likely effects of trade and fiscal policy, for example) before considering any changes in monetary policy.”8

|

|

|

1. USA Today, April 4, 2025 [https://www.usatoday.com/story/graphics/2025/04/04/stock-markets-tumble-trump-tariffs-dow/82877494007/]

2. USA Today, April 4, 2025 [https://www.usatoday.com/story/graphics/2025/04/04/stock-markets-tumble-trump-tariffs-dow/82877494007/]

Chart - USA Today, April 4, 2025 [https://www.usatoday.com/story/graphics/2025/04/04/stock-markets-tumble-trump-tariffs-dow/82877494007/]

3. Fox Business, April 4, 2025 [https://www.foxbusiness.com/live-news/stocks-sink-after-trump-tariffs-live-updates]

4. MarketWatch.com, April 1, 2025

5. The Wall Street Journal, April 2, 2025

6. MarketWatch.com, April 3, 2025

7. The Wall Street Journal, April 4, 2025

8. MarketWatch.com, April 4, 2025 Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general. U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors. International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility. Please consult your financial professional for additional information. This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security. Copyright 2025 FMG Suite. |

|

|

|

|

|